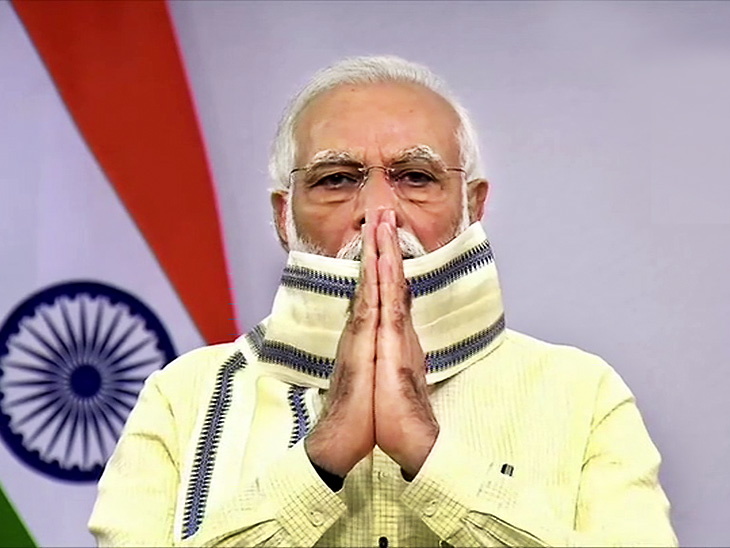

The platform, ‘Transparent Taxation — Honouring the Honest’, will be launched by the prime minister via video-conferencing just a couple of days before India celebrates its Independence Day on August 15.

New Delhi, August 12:

Prime Minister Narendra Modi is all set to launch a transparent scheme to reward honest taxpayers on Thursday.

The platform, ‘Transparent Taxation — Honouring the Honest’, will be launched by the prime minister via video-conferencing just a couple of days before India celebrates its Independence Day on August 15.

The event will be attended by various Chambers of Commerce, Trade Associations, Chartered Accountants’ associations and eminent taxpayers besides officials from the Income Tax Department, reported news agency PTI.

Finance Minister Nirmala Sitharaman will also be present during the launch of the new tax scheme.

While there are little details about the fresh tax scheme, a report published in the Indian Express suggested that the Prime Minister’s Office (PMO) has been holding several meetings with senior tax officials regarding faceless assessment and scrutiny of tax returns.

Quoting a senior tax official, the Indian Express report added that the prime minister’s address about the new scheme will largely focus on faceless assessment and transparency boosting measures with additional focus on further easing the process of filing returns for taxpayers.

All you need to know about recent tax reforms

The Central Board of Direct Taxes (CBDT) has carried out several major tax reforms in direct taxes in the recent years, the statement pointed out.

Last year, corporate tax rates were reduced from 30 per cent to 22 per cent, and for new manufacturing units, the rates were reduced to 15 per cent, it said.

Dividend distribution tax was also abolished, it added.

The focus of the tax reforms has been on reduction in tax rates and on simplification of direct tax laws. Several initiatives have been taken by the CBDT for bringing in efficiency and transparency in the functioning of the Income Tax (IT) Department, the statement said.

This includes bringing more transparency in official communication through the newly introduced Document Identification Number (DIN), wherein every communication of the department would carry a computer-generated unique document identification number, the statement said.

Similarly, to increase the ease of compliance for taxpayers, the IT Department has moved forward with prefilling of income tax returns to make compliance more convenient for individual taxpayers.

Compliance norms for startups have also been simplified, it said.

With a view to provide for resolution of pending tax disputes, the IT Department also brought out the Direct Tax “Vivad se Vishwas Act, 2020”, under which declarations for settling disputes are being filed currently.

To effectively reduce taxpayer grievances and litigation, the monetary thresholds for filing of departmental appeals in various appellate courts have been raised.

Several measures have been taken to promote digital transactions and electronic modes of payment, it said.

The IT Department has also made efforts to ease compliances for taxpayers during the COVID-19 pandemic by extending statutory timeliness for filing returns, as also releasing refunds expeditiously to increase liquidity in the hands of taxpayers, the statement pointed out.