File your GST return on time to get timely benefits: GST Expert

JK News Today

Jammu, August 17:

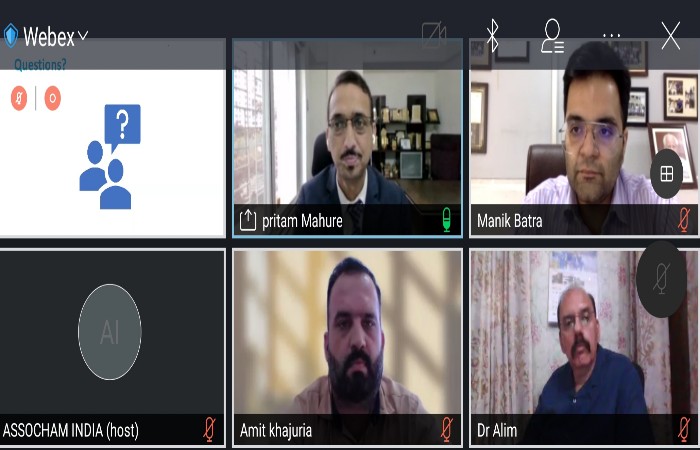

J&K Council of The Associated Chamber of Commerce and Industry of India (ASSOCHAM) has organized GST workshop on Tuesday on its virtual platform to educate the traders and industrialists of the Jammu and Kashmir about the functioning and benefits of GST.

Pritam Mahure – an internationally recognized speaker, writer and advisor on GST/ VAT has address a largely attended workshop.

The session was started with the Welcome address by Manik Batra, Chairman, ASSOCHAM, J&K Council.

“Government has extended so many benefits under GST law, which can increase the income of the businessman. I always suggest every businessman to consult his CA for any issue related to GST and file their GST returns on time,” said CA Pritam Mahure, an expert on GST.

Mahure also answered all the queries raised by the attendees of the workshop and cleared their doubts about the topic.

Manik Batra, Chairman ASSOCHAM J&K Council Said, “We were fortunate to listen to CA Pritam Mahure today on GST, he gave a very detailed view on GST & its provisions, the session was very informative and most of the doubts of our members were cleared.”

“Many people face problems with regards to GST Input, he explained and clarified where all we go wrong when claiming an Input. We would organise more such workshops in the future to help our members from trade and industry in J&K,” he added.

The session concluded with the vote of Thanks by Dr. M A Alim, Co-Chairman, ASSOCHAM J&K Council.

“It was a much required workshop for the business community of Jammu and Kashmir, as many of the benefits shared by Pritam Mahure were not known to us and we were missing out such benefits under GST,” said Dr. M A Alim, Co-Chairman, ASSOCHAM, J&K Council.

“ASSOCHAM will continue to organise such informative sessions in future for the benefits of trade and industry of Jammu and Kashmir,” he added.